Alex Hormozi: How I Lost $217,000 on A Day Trade & How I Trade Now

Last updated: Jun 15, 2023

The video is about Alex Hormozi sharing his experience of losing $217,000 on a day trade and discussing the pitfalls of short-term investing and the benefits of long-term investing.

This video by Alex Hormozi was published on May 19, 2021.

Video length: 09:45.

In this video, Alex Hormozi talks about the pitfalls of long-term and short-term investing and shares some mistakes he has made in his transition from CEO to investor/capital allocator.

He discusses a study by Fidelity or Charles Schwab that found that the best-performing investor profiles were those who had purchased stocks and then died or those who had purchased stocks and forgotten their password, highlighting the flaws in human judgment and the power of compounding growth.

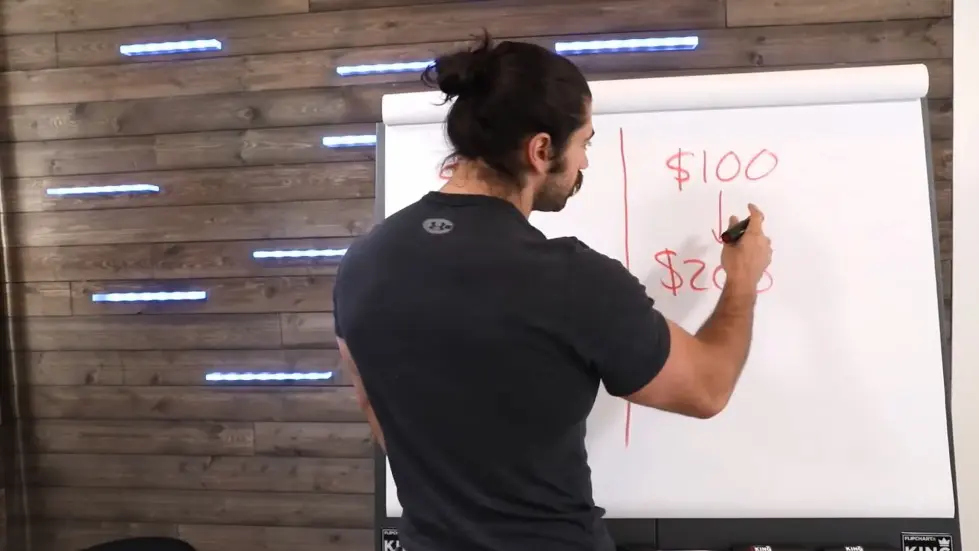

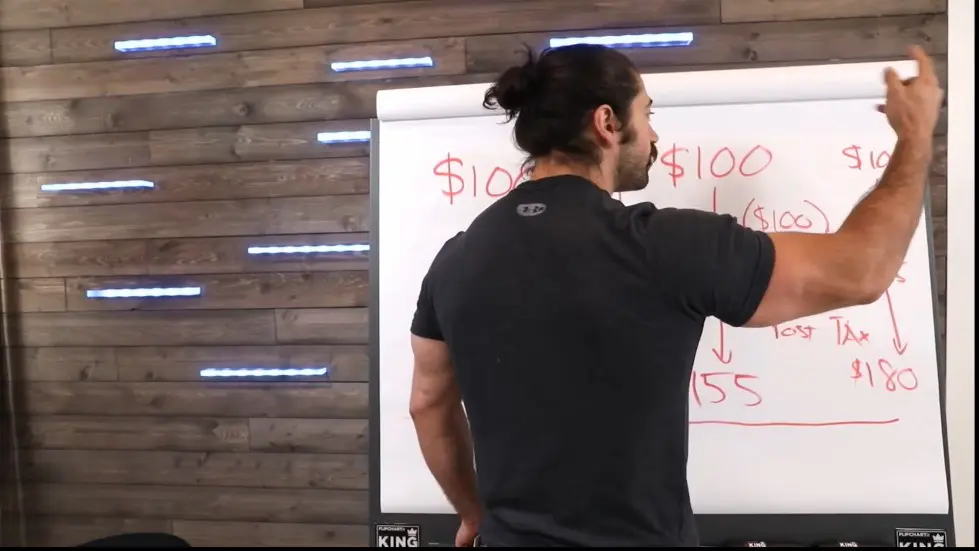

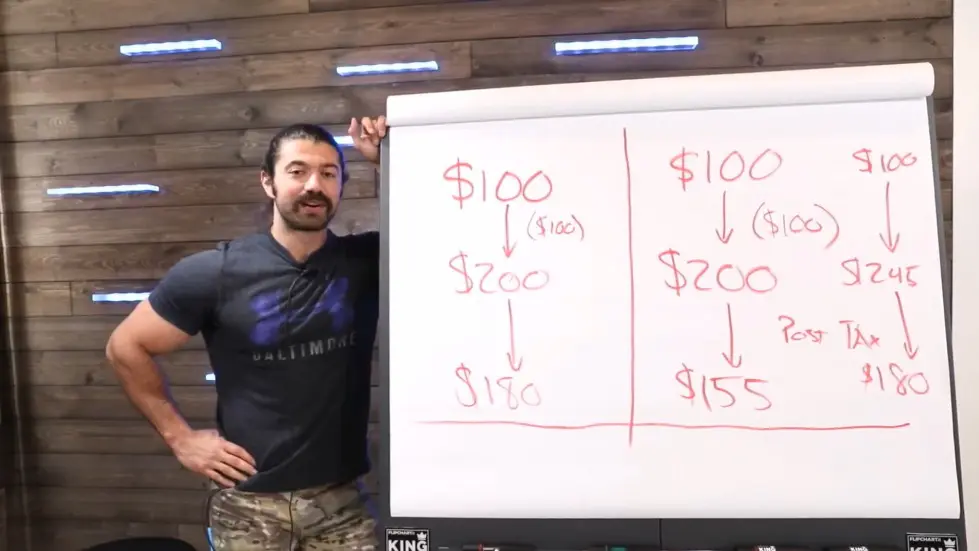

Hormozi also shares a mistake he made in day trading that cost him $217,000 and explains the difference between holding and trading, using a $100 example to show how quickly trading can lead to higher taxes and lower returns.

- Alex Hormozi shares his experience of losing $217,000 on a day trade and discusses the pitfalls of short-term investing and the benefits of long-term investing.

- Fidelity or Charles Schwab found that the highest performing portfolio activity were people who had purchased stocks and then died, and the second highest were people who purchased stocks and then had forgotten their password.

- Alex Hormozi made a mistake that cost him $217,000 on a day trade and wants to explain the difference between holding versus trading.

- If you're doing this through trading, then the capital gains treatment gets thrown out the window and it becomes regular income.

- It's better to hold and let the compounding work for you.

How I Lost $217,000 on A Day Trade & How I Trade Now - YouTube

Introduction

- Alex Hormozi is an entrepreneur, investor, and CEO of Acquisition.com.

- He shares his experience of losing $217,000 on a day trade and discusses the pitfalls of short-term investing and the benefits of long-term investing.

Investor Profiles and Activity

- Fidelity or Charles Schwab did a study on which investor profiles and activity yielded the best returns in terms of total portfolio value in stocks.

- They found that there were two categories that far outpaced everyone else.

- The first and highest performing portfolio activity were people who had purchased stocks and then died.

- The second highest were people who purchased stocks for the account and then had forgotten their password as a result had not done any trading.

- It shows the power of compounding growth when buying businesses in general because then you just get exposure.

The $200,000 Mistake

- Alex Hormozi made a mistake that cost him $217,000 on a day trade.

- He has three to five percent of his portfolio in investable assets that he plays around with.

- He wants to explain the difference between holding versus trading.

- There are huge quantitative firms that have hundreds of analysts who are trying to beat you.

- He gives a simple hundred dollar example to show how quickly you shouldn't try to beat the market by trading.

How I Lost $217,000 on A Day Trade & How I Trade Now - YouTube

The Capital Gains Treatment

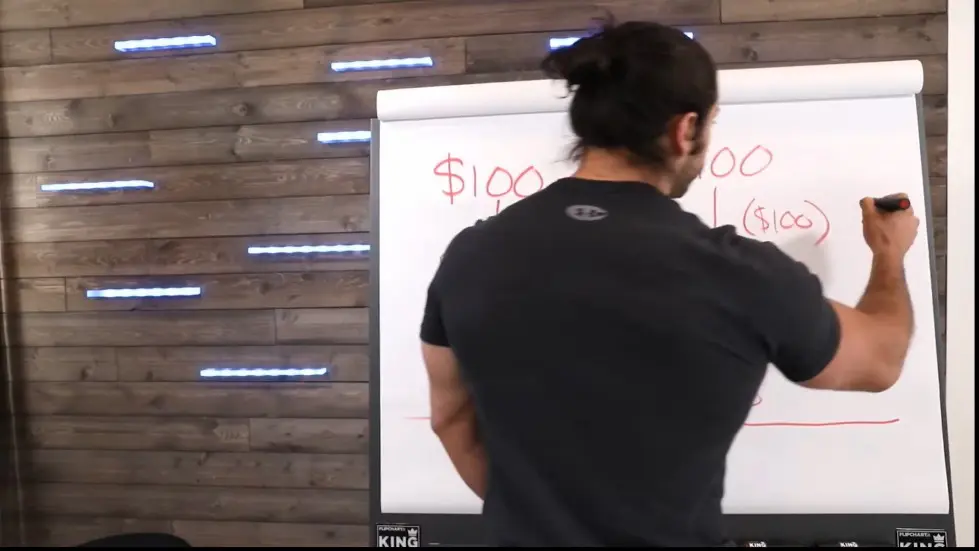

- If you're doing this through trading, then the capital gains treatment gets thrown out the window and it becomes regular income.

- The hundred dollar gain gets taxed at a higher rate.

- After tax, you're left with $155.

- Instead of trading, if you just earn the same amount, $100 turns to $200.

- It's better to hold and let the compounding work for you.

The Pitfalls of Short-Term Investing

- Passive investments outperform active investments.

- Capital gains tax treatment is more favorable than regular income tax treatment.

- Day trading or trading on shorter terms requires a significant amount of extra money to outpace the regular income tax treatment.

- In order to yield a net of $80, a $100 investment would have to turn into $245.

- Long-term investing is more profitable and less risky than short-term investing.

The Benefits of Long-Term Investing

- Long-term investing yields higher gains and less tax liability.

- Smart investors take all of their extra time and do something else.

- Get a hobby and let the money grow.

- Pretend you're a dead person and don't touch your investments.

- Long-term investing is more stable and less risky than short-term investing.

Watch the video on YouTube:

How I Lost $217,000 on A Day Trade & How I Trade Now - YouTube

Related summaries of videos:

- Alex Hormozi: Why I Used To Be Poor? Misunderstanding of Risk, Volatility, & Return

- Alex Hormozi: “The 3 Evil Es” That Almost Killed My Business

- Alex Hormozi: Millionaire Reveals “7 Things I Wish They Taught In School”

- Alex Hormozi: 4 Perspective Shifts Dr.Kashey Taught Me That Keep Me Going

- Alex Hormozi: The Talent Grid - How I Recognize Skill in Self & Team

- Alex Hormozi: I Taught 116+ Salesmen My Closing Framework

- Alex Hormozi: 9 Beliefs That Built My Ultra High Net Worth Got Me To $121M By Age 31

- Alex Hormozi: When Money Stopped Mattering

- Alex Hormozi: What I Learned After Countless Failed Business Partnerships

- Alex Hormozi: How I Accidentally Made $17M when I was 28 Using “Leverage”

- Home

- About us

- Contact

- Book Summaries 0-9

- Book Summaries A

- Book Summaries B

- Book Summaries C

- Book Summaries D

- Book Summaries E

- Book Summaries F

- Book Summaries G

- Book Summaries H

- Book Summaries I

- Book Summaries J

- Book Summaries K

- Book Summaries L

- Book Summaries M

- Book Summaries N

- Book Summaries O

- Book Summaries P

- Book Summaries Q

- Book Summaries R

- Book Summaries S

- Book Summaries T

- Book Summaries U

- Book Summaries V

- Book Summaries W

- Book Summaries X

- Book Summaries Y

- Book Summaries Z

- Jay Shetty Podcast - Summaries

- Tom Bilyeu Impact Theory - Summaries

- Lex Fridman - Summaries

- Diary of a CEO - Summaries

- Alex Hormozi - Summaries