Alex Hormozi: How wealthy people avoid paying taxes..my new plan

Last updated: Jun 15, 2023

The video discusses how business owners can get paid tax-free through the use of debt, rather than selling their business, which can result in high taxes and a lower net worth.

This video by Alex Hormozi was published on Nov 26, 2021.

Video length: 08:09.

In this video, Alex Hormozi explains how business owners can get paid tax-free without giving up any equity by using debt.

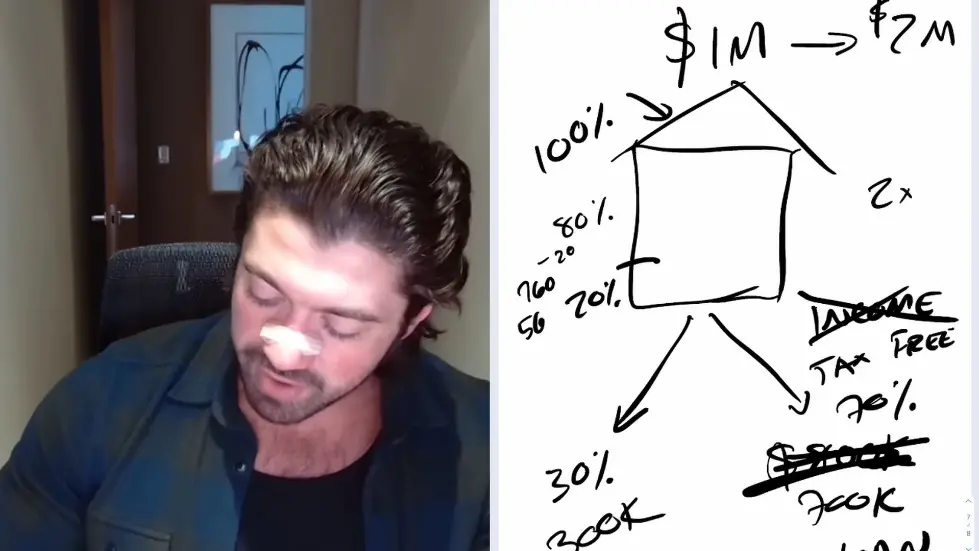

He uses the analogy of a house to explain how business owners can split their business into equity and a loan, allowing them to share the risk and receive tax-free income.

Hormozi emphasizes that this strategy can help business owners avoid the high taxes associated with selling a business and keep more of their net worth.

- Business owners can get paid tax-free without giving up equity by using debt.

- Debt can be used to share the risk of the business with others.

- Using debt can be a better option than selling the business, which can result in high taxes and a lower net worth.

- The loan against the business is not income, which means it is tax-free.

- A house analogy is used to explain how debt can be used to finance a portion of the business.

How wealthy people avoid paying taxes..my new plan - YouTube

Introduction

- Alex Hormozi explains how business owners can get paid for their business tax-free without giving up any equity.

- He owns Acquisition.com and a portfolio of companies that generate about $85 million a year.

- He wants to share his knowledge about debt and how it is used in mergers and acquisitions.

Why Business Owners Want to Sell Their Business

- Many business owners want to exit their business because it seems like a big aspirational goal.

- However, the reality of the exit is not nearly as inspiring as the story of the exit.

- Transition documents, earn outs, seller financing, equity roll, cash, bonuses, distributions, financing costs, and transaction costs are all involved in the exit process.

- After paying taxes, the business owner may be left with a lower net worth than expected.

- The wealthiest people in the world buy and build, and most times they don't sell.

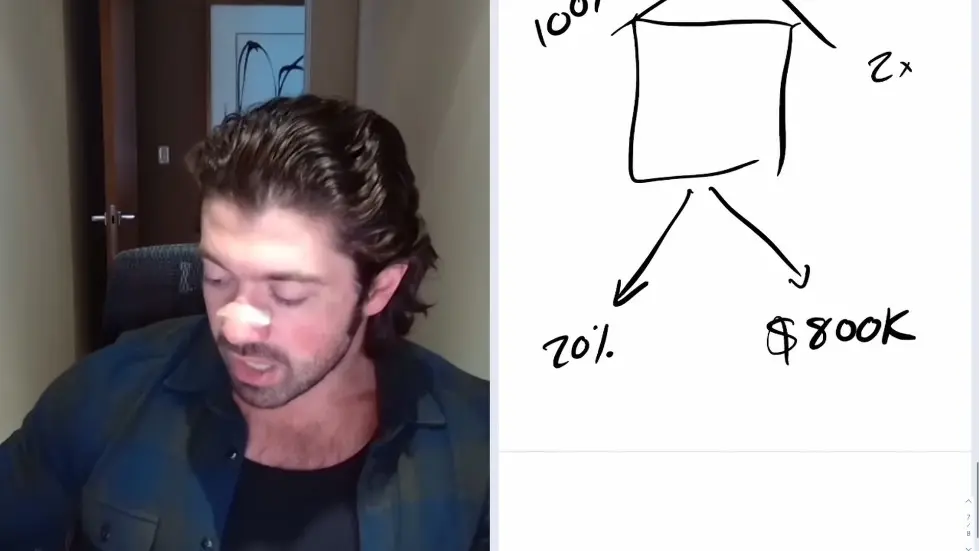

How to Get Paid or De-Risk

- The majority of a business owner's net worth is in their business, which is a high-risk asset class.

- Business owners can share some of that risk with other people by using debt.

- Debt can be used to finance a portion of the business, which can be paid back over time.

- The loan against the business is not income, which means it is tax-free.

- Business owners can keep a portion of the business and get a loan for the rest.

How wealthy people avoid paying taxes..my new plan - YouTube

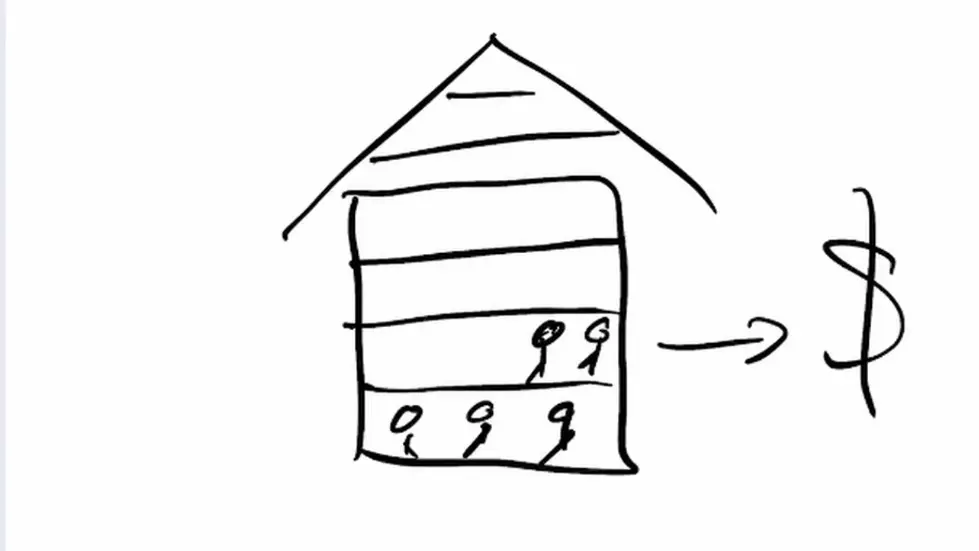

An Analogy: A House

- A house can be built without land, using only the owner's money.

- Once the house is built, tenants can be added to generate cash flow.

- The owner can get a loan in the form of debt to finance a portion of the house.

- The loan against the house is not income, which means it is tax-free.

- The owner can keep a portion of the house and get a loan for the rest.

The Benefits of Using Debt

- Using debt allows business owners to get paid tax-free without giving up any equity.

- Debt can be used to share some of the risk of the business with other people.

- Business owners can keep a portion of the business and get a loan for the rest.

- The loan against the business is not income, which means it is tax-free.

- Using debt can be a better option than selling the business, which can result in high taxes and a lower net worth.

How to Get Paid Tax-Free Through Debt

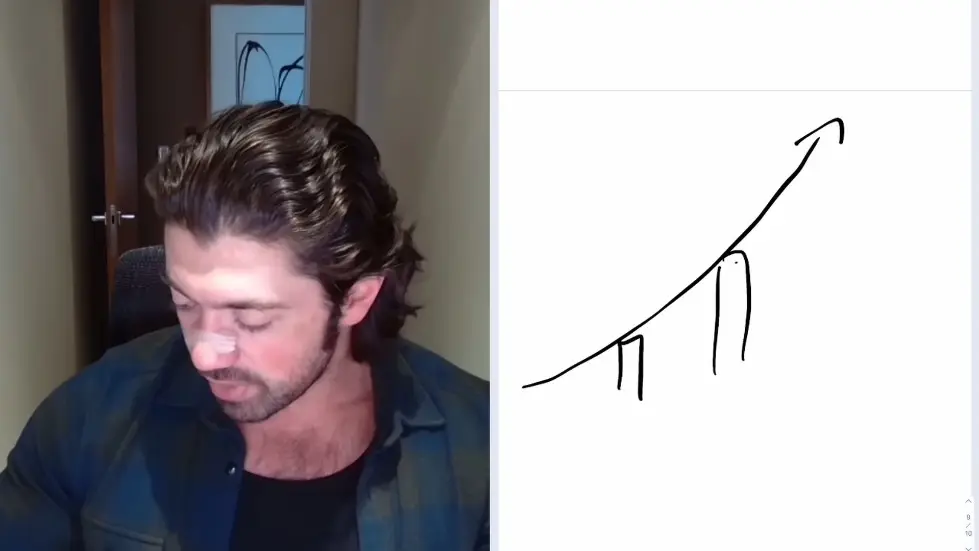

- Through debt, business owners can get a loan and still own the business.

- Business owners can grow their business and the loan at the same time.

- Business owners can own the delta, which increases their net worth.

- There are many ways to take out debt in the company, such as minority, majority, and dividend recap.

- Business owners can refinance at regular intervals as the value of the business grows.

Why Taking Loans Against Equity is Beneficial

- CEOs of publicly traded companies live off of loans that are asset-based.

- Stocks grow tax-free because they compound, and loans are locked in.

- Business owners can gain money without paying income tax on the loans they took against their assets.

- Business owners can de-risk themselves and put their money in other assets.

- Taking loans against equity is a way to grow net worth faster in a lower risk environment.

- Business owners can take loans against equity to redeploy it and do other things.

Watch the video on YouTube:

How wealthy people avoid paying taxes..my new plan - YouTube

Related summaries of videos:

- Alex Hormozi: $100M CEO explains: How to CREATE a $100,000,000 product..[leaked training]

- Alex Hormozi: Why entrepreneurs stay broke and sad [trigger warning]

- Alex Hormozi: The truth about retiring at age 31 with $100,000,000

- Alex Hormozi: $100M CEO: "How to make the HARD decisions that change your life"

- Alex Hormozi: The 4 RAREST skills on earth that make BILLIONAIRES...

- Alex Hormozi: *REVEALED* Compensation plans that ACTUALLY WORK...

- Alex Hormozi: A DOER's approach to PROCRASTINATION

- Alex Hormozi: MASTER CONTENT STRATEGY for our $85M/yr portfolio...

- Alex Hormozi: 7 figure CONFIDENTIAL meeting LEAKED - business growth STRATEGY exposed...

- Alex Hormozi: Watch these 55 minutes if you want to be a millionaire in 2022..

- Home

- About us

- Contact

- Book Summaries 0-9

- Book Summaries A

- Book Summaries B

- Book Summaries C

- Book Summaries D

- Book Summaries E

- Book Summaries F

- Book Summaries G

- Book Summaries H

- Book Summaries I

- Book Summaries J

- Book Summaries K

- Book Summaries L

- Book Summaries M

- Book Summaries N

- Book Summaries O

- Book Summaries P

- Book Summaries Q

- Book Summaries R

- Book Summaries S

- Book Summaries T

- Book Summaries U

- Book Summaries V

- Book Summaries W

- Book Summaries X

- Book Summaries Y

- Book Summaries Z

- Jay Shetty Podcast - Summaries

- Tom Bilyeu Impact Theory - Summaries

- Lex Fridman - Summaries

- Diary of a CEO - Summaries

- Alex Hormozi - Summaries