Alex Hormozi: "My business has stopped growing..what should I do?"

Last updated: Jun 15, 2023

The video is about a framework that Alex Hormozi uses to analyze businesses and how to use it to instantly 2-3 exit your own business.

This video by Alex Hormozi was published on Oct 1, 2021.

Video length: 09:25.

In this video, Alex Hormozi shares a framework for analyzing a business that can help entrepreneurs instantly 2-3x their business.

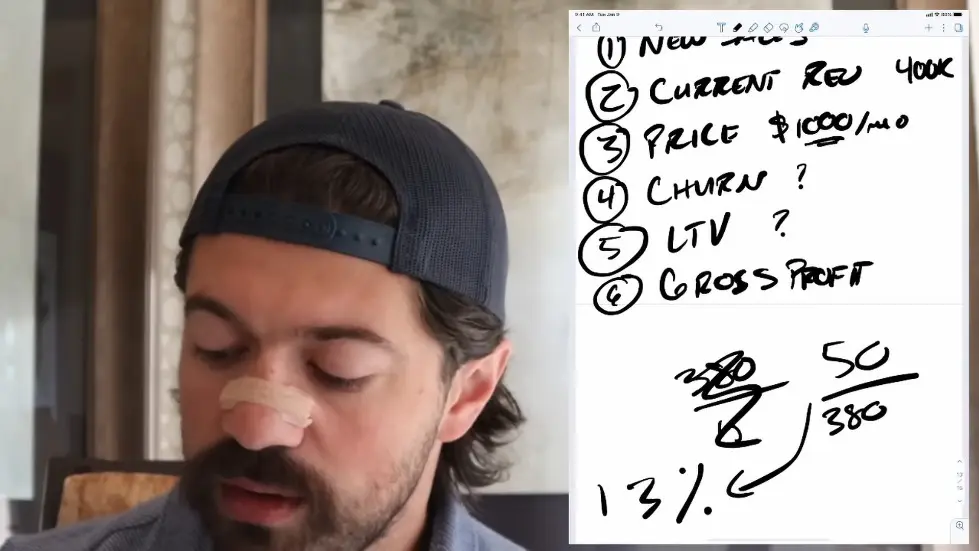

He explains the five variables needed for the framework: number of new sales per month, current revenue, price, churn, and lifetime value. He then walks through a hypothetical example of a business with 100 new sales per month, 380 active clients, a $1,000/month price, and a 13% churn rate.

Using this information, he calculates the business's hypothetical max and lifetime gross profit per customer, which can help entrepreneurs analyze the potential opportunity of their business.

- Alex Hormozi shares a framework to analyze businesses and how to use it to instantly 2-3 exit your own business.

- The framework requires five variables: new sales per month, current revenue, price, churn, lifetime value, and gross profit.

- A hypothetical example is used to demonstrate how to calculate churn and lifetime value to determine the hypothetical max revenue of a business.

- Business owners can use this framework to calculate their own churn and lifetime value, determine their hypothetical max revenue, and make informed decisions about growth opportunities.

- It is important to ensure that customer acquisition cost is less than lifetime gross profit per customer.

"My business has stopped growing..what should I do?" - YouTube

Introduction

- Alex Hormozi is an entrepreneur, investor, and CEO of Acquisition.com.

- He shares a framework that he uses to analyze businesses and how to use it to instantly 2-3 exit your own business.

- The framework requires five variables, and he will show how to get the two hardest numbers that most people don't know how to get within their business.

The Five Variables

- The number of new sales per month.

- Current revenue.

- Price.

- Churn.

- Lifetime value.

- Gross profit.

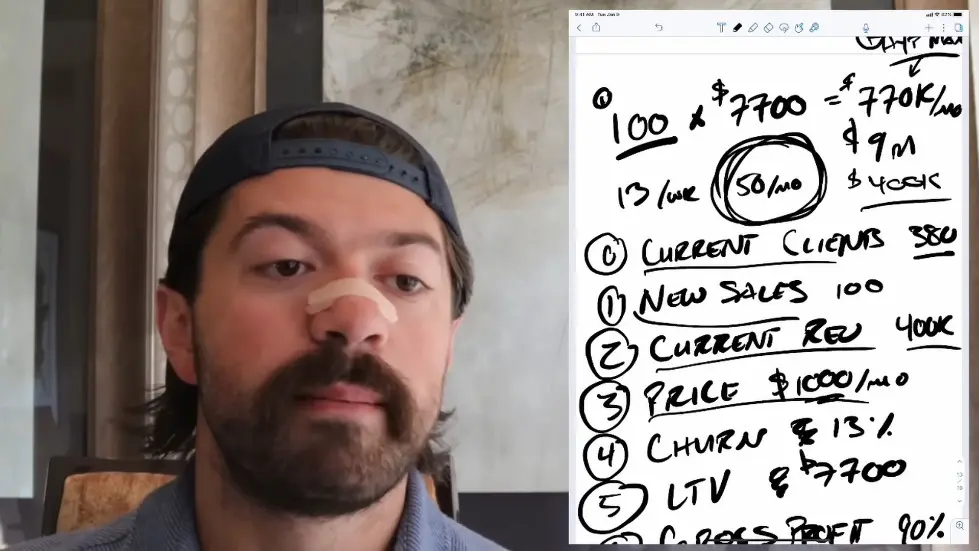

Analyzing a Hypothetical Example

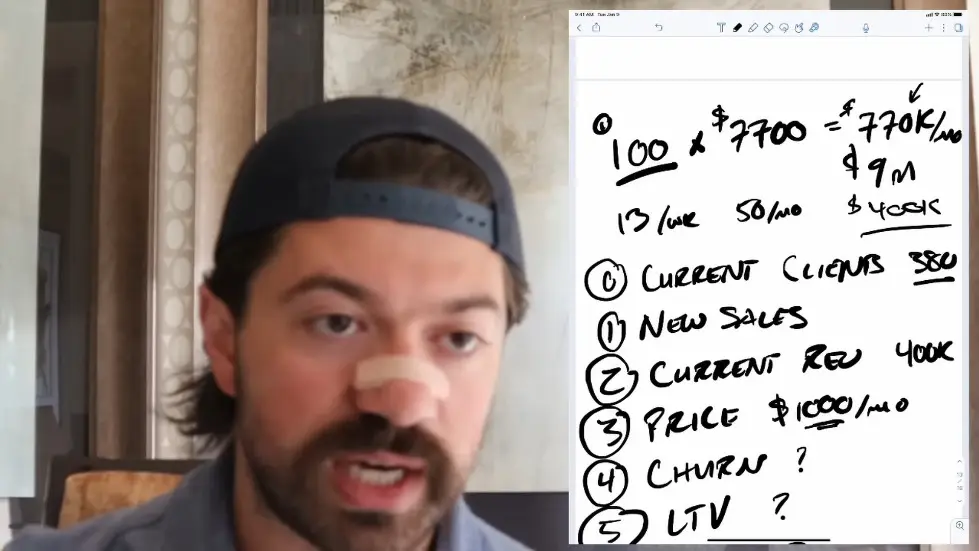

- A business was doing 100 new sales per month and $400k in revenue.

- They had 380 clients paying $1,000 per month, but they didn't know their churn or lifetime value.

- Alex helped them calculate their churn, which was 13%.

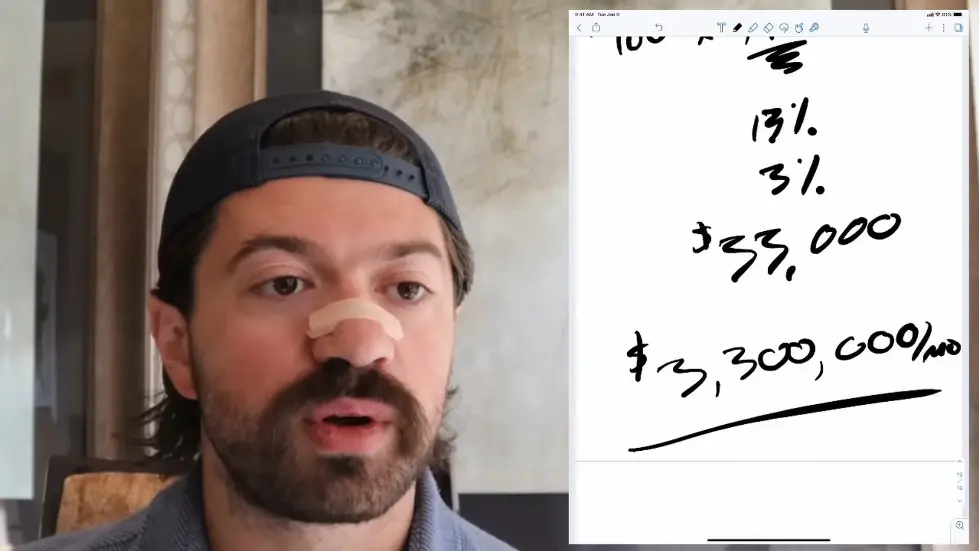

- He then calculated their lifetime value per customer, which was $7,700.

- Using these numbers, he determined that the business would cap out at $770k per month or about $9 million per year.

- The business had over 90% gross margins, which meant their lifetime gross profit per customer was $7,000.

"My business has stopped growing..what should I do?" - YouTube

Using the Framework to Analyze Your Own Business

- Calculate your churn and lifetime value.

- Use these numbers to determine your hypothetical max revenue.

- Calculate your gross profit per customer.

- Ensure that your customer acquisition cost is less than your lifetime gross profit per customer.

- Use this information to make informed decisions about your business and potential growth opportunities.

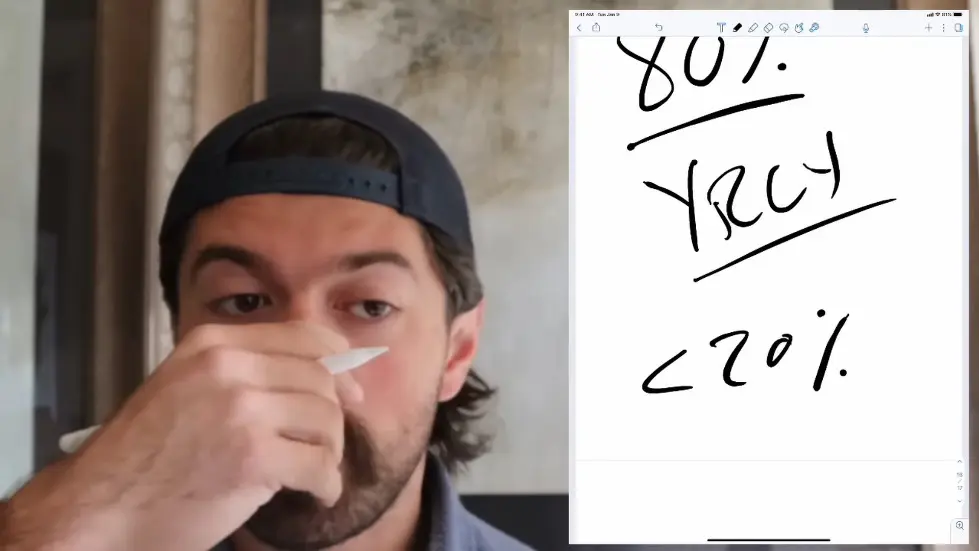

Framework for Analyzing Businesses

- A business can only grow by getting more customers or making them worth more.

- Increasing customer acquisition or increasing customer value are the only ways to grow a business.

- Reducing churn can significantly increase customer value and overall revenue.

- Private equity firms look for businesses with high growth, stickiness, and profitability.

- Removing the biggest constraint in a business can allow it to grow.

Calculating Hypothetical Max and Weak Points

- Calculating hypothetical max with current numbers can reveal weak points in a business model.

- Knowing how many new customers, current clients, and revenue a business has can help calculate hypothetical max.

- Calculating churn can help identify areas for improvement in a business model.

- The theory of constraints suggests that businesses will grow up to their nearest constraint, so removing constraints can allow for growth.

- Smart business owners focus on doing the fewest things that get them the most returns.

Watch the video on YouTube:

"My business has stopped growing..what should I do?" - YouTube

Related summaries of videos:

- Alex Hormozi: NEVER lower your prices...

- Alex Hormozi: 5 UNTAPPED Industries that could make you a BILLIONAIRE

- Alex Hormozi: I cracked Starbucks RECURRING SALES model and built a FORTUNE...

- Alex Hormozi: How to get unlimited funding to build your business in 30 days...

- Alex Hormozi: Why PRETENDING to be RICH will make you POOR..

- Alex Hormozi: 5 Things that BILLIONAIRES think about that MILLIONAIRES don't...

- Alex Hormozi: The ONLY 4 ways to MAKE BILLIONS as a service based business..

- Alex Hormozi: The SIMPLE FORMULA that has DESTROYED BILLION DOLLAR BUSINESSES

- Alex Hormozi: This QUICK FIX will make us an EXTRA $10,000,000 next year..

- Alex Hormozi: How to build a $100,000,000 business...the sh@$ nobody will tell you..

- Home

- About us

- Contact

- Book Summaries 0-9

- Book Summaries A

- Book Summaries B

- Book Summaries C

- Book Summaries D

- Book Summaries E

- Book Summaries F

- Book Summaries G

- Book Summaries H

- Book Summaries I

- Book Summaries J

- Book Summaries K

- Book Summaries L

- Book Summaries M

- Book Summaries N

- Book Summaries O

- Book Summaries P

- Book Summaries Q

- Book Summaries R

- Book Summaries S

- Book Summaries T

- Book Summaries U

- Book Summaries V

- Book Summaries W

- Book Summaries X

- Book Summaries Y

- Book Summaries Z

- Jay Shetty Podcast - Summaries

- Tom Bilyeu Impact Theory - Summaries

- Lex Fridman - Summaries

- Diary of a CEO - Summaries

- Alex Hormozi - Summaries