Alex Hormozi: Warren Buffet’s Secret Weapon (and how I made $53M using it)

Last updated: Jun 14, 2023

The video discusses the importance of tracking net free cash flow in businesses and how taking money out of a business while still growing it can lead to more profits in the long run, using the speaker's personal experience and Warren Buffet's endorsement as examples.

This video by Alex Hormozi was published on May 5, 2021.

Video length: 12:35.

In this video, Alex Hormozi discusses the importance of tracking net free cash flow as the number one metric for businesses.

He shares his personal experience of reinvesting profits back into his businesses and how it led to him being asset-rich but cash-poor. He emphasizes the need for entrepreneurs to focus on making money while growing their businesses and taking money out of the business every year.

He also warns against the unrealistic expectation of a mythical exit and the importance of getting paid to grow the business through net free cash flow.

- Net free cash flow is the most important metric for businesses.

- Entrepreneurs should focus on net free cash flow and take money out of the business while still growing it.

- 99% of businesses don't get sold ever.

- The end goal for entrepreneurs should be to make money while growing their business.

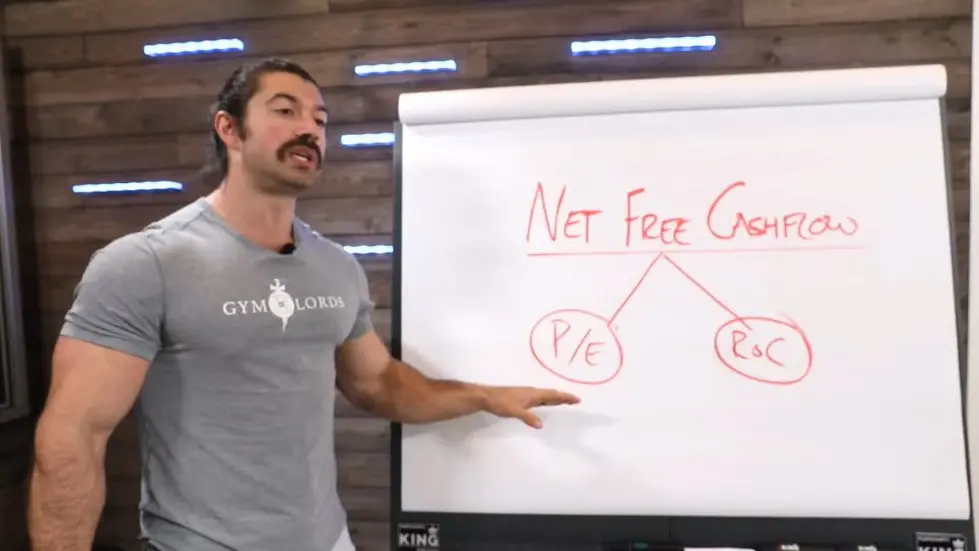

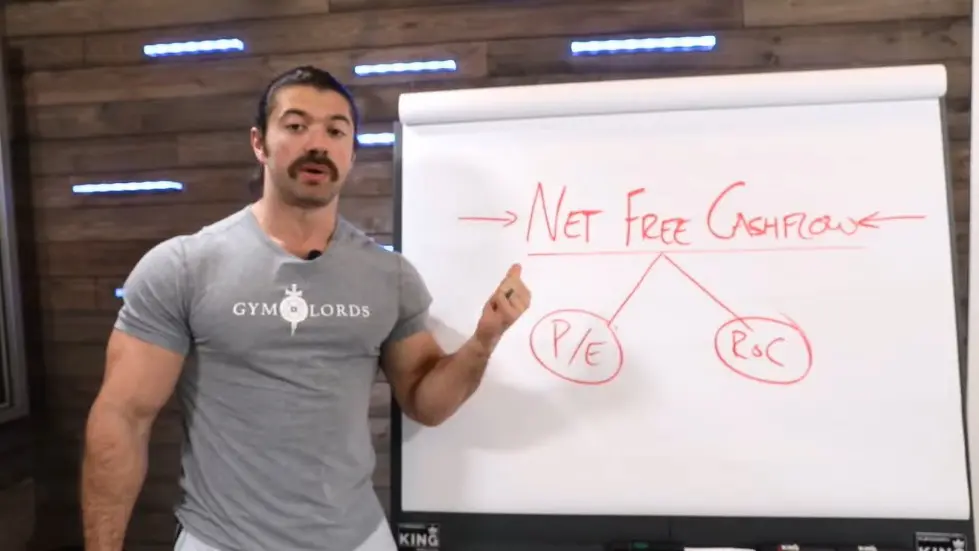

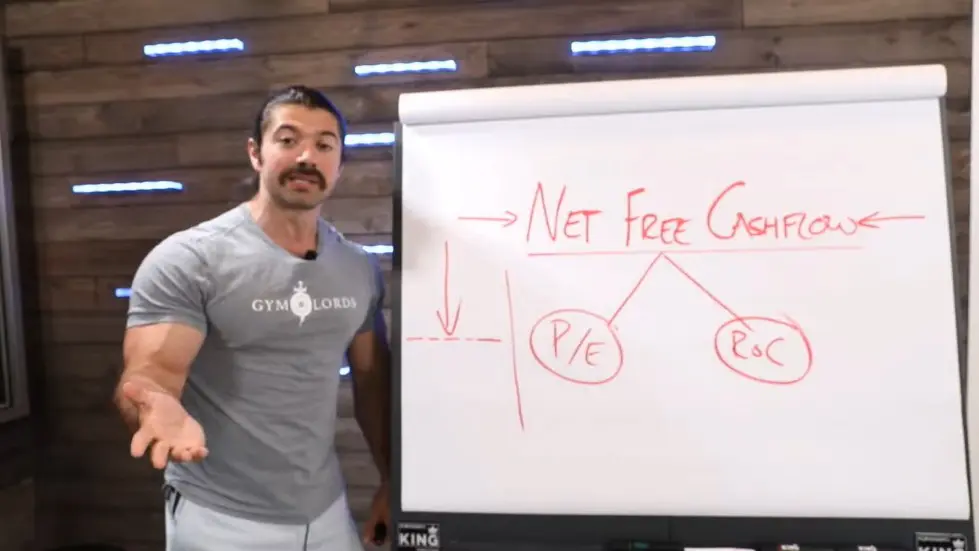

- The two metrics that are important for getting above average returns are the price to earnings ratio (P/E ratio) and return on capital.

- As business owners, we take on a lot of risk and need to reward ourselves for that risk.

- The P/E ratio and return on capital are important because they help you find mispriced bets.

Warren Buffet’s Secret Weapon (and how I made $53M using it) - YouTube

The Importance of Net Free Cash Flow

- Net free cash flow is the most important metric to track for businesses.

- Net free cash flow is the amount of money that an owner of a business can take out of the business after the business reinvests in staying ahead of the competition and maintaining its competitive advantage.

- The problem with the vast majority of businesses and business owners is that they don't make any profit.

- Many businesses take their profit and reinvest it back into the business, which can be a bad idea.

- Entrepreneurs should focus on net free cash flow and think about how they can take money out of the business every single year while still growing it.

The Speaker's Personal Experience

- The speaker made the mistake of reinvesting all the profits from his gyms into opening new locations.

- He ended up being asset rich and cash poor, which caused problems.

- When he sold his gyms, he didn't get a lot of money for them.

- He promised himself that he would never make that mistake again.

- Entrepreneurs should focus on net free cash flow and take money out of the business while still growing it.

The Myth of the Exit

- Many entrepreneurs have the dream of selling their business for a lot of money, but the reality is that the chips are stacked against them.

- 99% of businesses don't get sold ever.

- Of the businesses that do get sold, many of those exits aren't as sexy as they may sound.

- Entrepreneurs should focus on net free cash flow and getting paid to grow their business.

- Entrepreneurs should not grow irresponsibly and expose themselves to higher risk and more mistakes.

Warren Buffet’s Secret Weapon (and how I made $53M using it) - YouTube

The End Goal

- The end goal for entrepreneurs should be to make money while growing their business.

- Entrepreneurs should focus on net free cash flow and think about how they can take money out of the business every single year while still growing it.

- Entrepreneurs should not focus on growing too quickly for arbitrary reasons.

- Entrepreneurs should focus on net free cash flow and getting paid to grow their business.

- Entrepreneurs should not lose sight of the one thing they get along the way, which is net free cash flow.

The Importance of Net Free Cash Flow

- Net free cash flow focuses the entire company on making a profit in excess of what is required to run and grow the business.

- Net free cash flow is the number one stat that the speaker looks at and tracks.

- Warren Buffet and Charlie Munger calculate owner earnings using net free cash flow.

- Net free cash flow is important because it tells you how much money you get to deposit at the end of every month.

- Operational risk is something that we are all exposed to and net free cash flow helps to mitigate that risk.

The Two Metrics for Above Average Returns

- The two metrics that are important for getting above average returns are the price to earnings ratio (P/E ratio) and return on capital.

- The P/E ratio tells you whether a business is cheap or not.

- Return on capital tells you the quality of the business you are buying.

- Combining these two metrics can help you consistently beat the market.

- Companies with the lowest P/E ratio and highest return on capital are usually mispriced bets.

The Importance of Rewarding Yourself for Risk

- As business owners, we take on a lot of risk and need to reward ourselves for that risk.

- Net free cash flow is the speaker's home base and what he cares about the most.

- Tomorrow may never come, so it's important to take money out of the business every month to make money along the way.

- There is a 99 to 1 chance of not succeeding if you're solely doing this with the hope of selling someday.

- Taking money out of the business while still growing it can lead to more profits in the long run.

The Beauty of the Two Metrics

- The P/E ratio and return on capital are important because they help you find mispriced bets.

- Half of the companies that meet these two qualifications end up tanking, but the other half outperform the price that you're paying for them.

- Companies that meet these two qualifications are usually going through issues and are disproportionately discounted in pricing.

- Combining these two metrics can help you consistently beat the market.

- A great business is a business that can take a small amount of money and generate lots of cash from it.

The Importance of Tracking Net Free Cash Flow in Businesses

- Tracking net free cash flow allows you to know every month how the business is really doing.

- Leaving money in the business account can make it difficult to get a feeling for how the business is doing.

- One easy tactic is to come up with a line and say everything over that line will be taken out of the business every month.

- Measuring net free cash flow is important because it is one of the most important metrics.

- When reinvesting in the business, make sure the dollars being reinvested are getting the best return on capital possible.

- Your wealth doesn't necessarily have to be generated entirely from your business or from a sale that may not actually happen.

Watch the video on YouTube:

Warren Buffet’s Secret Weapon (and how I made $53M using it) - YouTube

Related summaries of videos:

- Alex Hormozi: How my job changed from $10k/day to $100,000/day

- Alex Hormozi: 3 Landing Page Tests To Skyrocket Conversions & Optins

- Alex Hormozi: I Spent $312,900 Living Like The 1% (Here's What I Learned)

- Alex Hormozi: 8 Lessons Charlie Munger Taught Me To Build $112M Business

- Alex Hormozi: I Broke Down Every High Margin Service Into 6 Buckets [Delivery Cube]

- Alex Hormozi: How I Lost $217,000 on A Day Trade & How I Trade Now

- Alex Hormozi: Why I Used To Be Poor? Misunderstanding of Risk, Volatility, & Return

- Alex Hormozi: “The 3 Evil Es” That Almost Killed My Business

- Alex Hormozi: Millionaire Reveals “7 Things I Wish They Taught In School”

- Alex Hormozi: 4 Perspective Shifts Dr.Kashey Taught Me That Keep Me Going

- Home

- About us

- Contact

- Book Summaries 0-9

- Book Summaries A

- Book Summaries B

- Book Summaries C

- Book Summaries D

- Book Summaries E

- Book Summaries F

- Book Summaries G

- Book Summaries H

- Book Summaries I

- Book Summaries J

- Book Summaries K

- Book Summaries L

- Book Summaries M

- Book Summaries N

- Book Summaries O

- Book Summaries P

- Book Summaries Q

- Book Summaries R

- Book Summaries S

- Book Summaries T

- Book Summaries U

- Book Summaries V

- Book Summaries W

- Book Summaries X

- Book Summaries Y

- Book Summaries Z

- Jay Shetty Podcast - Summaries

- Tom Bilyeu Impact Theory - Summaries

- Lex Fridman - Summaries

- Diary of a CEO - Summaries

- Alex Hormozi - Summaries